All Categories

Featured

[/image][=video]

[/video]

Let's say you have a hundred thousand dollars in a financial institution, and then you find it a financial investment, a submission or something that you're intending to place a hundred thousand right into. Now it's gone from the bank and it remains in the syndication. So it's either in the financial institution or the submission, among the two, yet it's not in both - how to create your own bank.

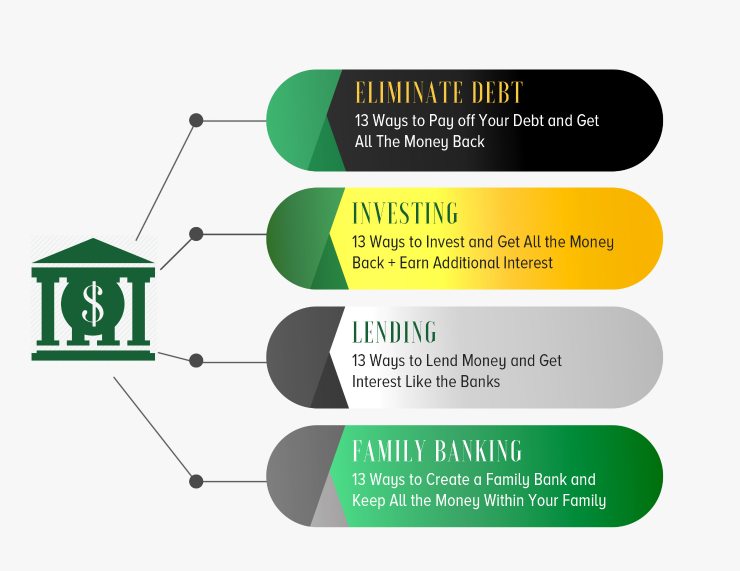

And I attempt to assist individuals comprehend, you understand, just how to boost that effectiveness of their, their money so that they can do more with it. And I'm actually going to try to make this simple of utilizing a possession to acquire another possession.

And after that you would certainly take an equity setting against that and utilize it to buy one more property. You recognize, that that's not an an international idea at all, remedy?

And after that utilizing that realty to buy even more realty is that then you end up being highly exposed to genuine estate, implying that it's all correlated. Every one of those assets end up being correlated. So in a recession, in the totality of the property market, then when those, you know, things begin to shed value, which does happen.

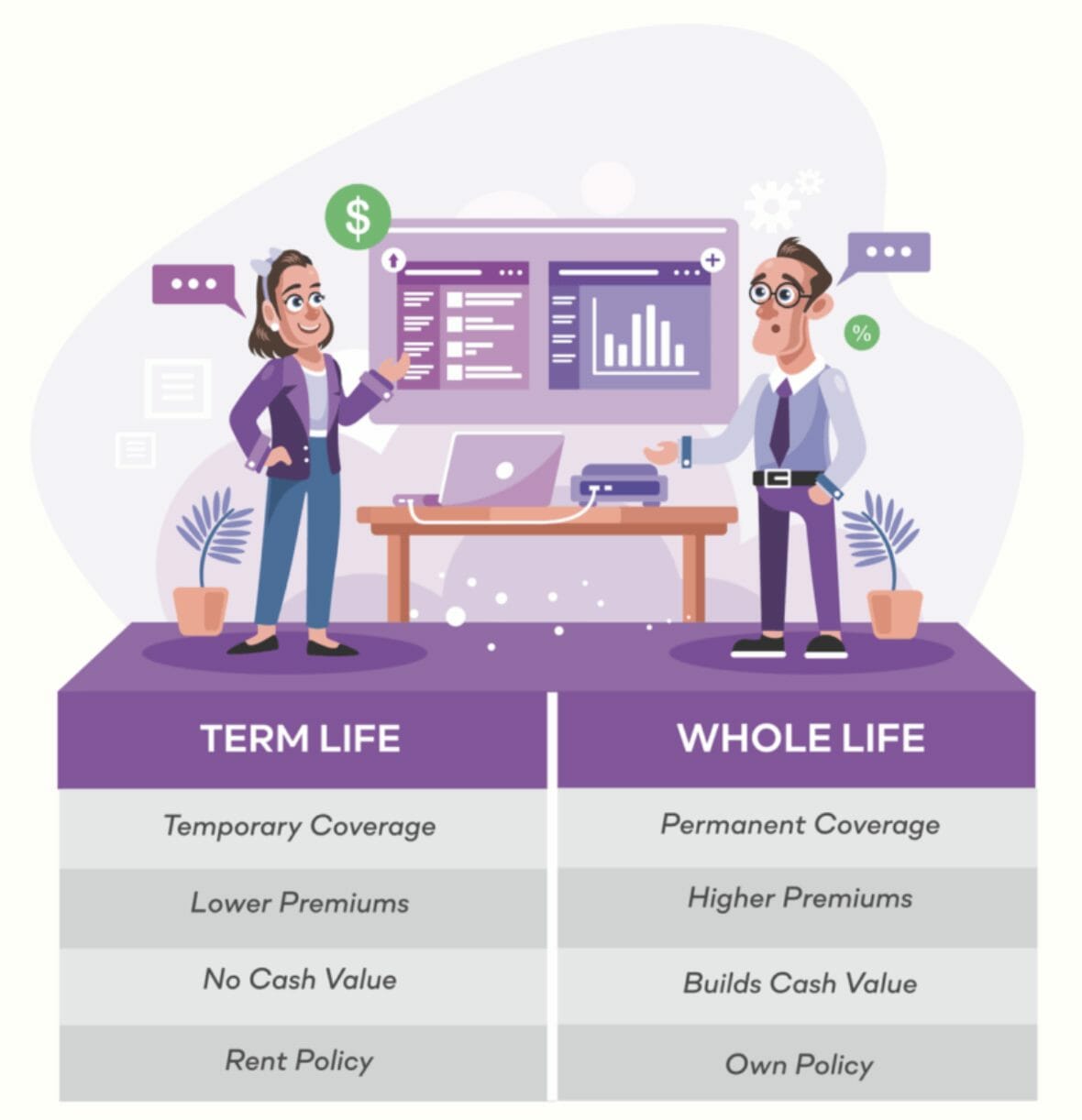

It hasn't happened in a while, yet I do not know. I keep in mind 2008 and 9 rather well. Uh, you know, and so you don't wish to have every one of your possessions correlated. So what this does is it offers you a location to put money initially that is completely uncorrelated to the genuine estate market that is mosting likely to exist assured and be assured to raise in value over time that you can still have a very high collateralization element or like a hundred percent collateralization of the cash value inside of these policies.

💰 Infinite Banking 💰 💰 Be Your Own Bank 💰 💰 Bank On ...

I'm trying to make that as straightforward as feasible. Does that make feeling to you Marco?

If they had a house worth a million bucks, that they had $500,000 paid off on, they could probably obtain a $300,000 home equity line of credit since they usually would get an 80 20 financing to worth on that. And they might obtain a $300,000 home equity line of debt.

Infinite Banking Toolkit

Okay. There's a great deal of issues with doing that however, that this resolves with my approach resolves. For one thing, that credit line is repaired. In other words, it's mosting likely to stay at $300,000, regardless of how much time it goes, it's going to stay at 300,000, unless you go get a brand-new evaluation and you get requalified economically, and you raise your credit rating line, which is a large pain to do whenever you put in cash, which is commonly annually, you contribute brand-new funding to one of these specifically designed bulletproof wide range plans that I create for people, your inner credit line or your access to capital goes up every year.

Latest Posts

Infinite Banking Video

Becoming Your Own Banker

Banking With Life